How to Calculate a Land Loan | Complete Guide 2025

📝 Introduction

Buying land is one of the most valuable investments, Whether for building a home, starting a business, or simply holding property for the future.. But Before applying for financing, it’s important to understand how to calculate a land loan.. Kno wing the exact monthly payments, interest rates, and down payment requirements will help you avoidd surprises and plan your budget more effectively..

A land loan calculator or manual calculation method allows you to estimate loan installments in advanced.. This not only helps in comparing different lenders but also ensures you choose the best financing option that fits your needs.. In this complete guide, we will Explain step-by-step methods, formulas, and tools that show you exactly how to calculate a land loan in the United States..

What is a Land Loan and Why Calculation Matters?

Land loan is a type of financing that allows you to purchase a piece of land When you do not have enough funds to buy it outright.. Unlike traditional home loans, land loans Are considered riskier by lenders because the property is often undeveloped and does not generate immediate value.. This makes calculating a land loan an essential step before applying..

When you learn how to calculate a land loan, you Gain a clear idea of the total costs you will be paying over time.. By estimating monthly Installments, Interest rates, an d down payments in advance, you can make informed decisions About affordability.. Accurate calculation also helps you compare loan offers from different banks Or credit unions, ensuring you choose the most cost-effective Option..

in short, Proper calculation prevents financial stress and gives you a realistic Roadmap for repayment.. whether you are purchasing residential, commercial, or agricultural land, knowing the numbers upfront is the smartest way to plan your Investment..

Step-by-Step Guide on How to Calculate a Land Loan

Calculating land loan may look complicated, But by following a few simple steps, you can estimate your monthly payments with accuracy.. here’s a breakdown of how it works:

Step 1 – Determine the Purchase Price of the Land

The first step in how to calculate a land loan is identifying the total cost of the land you want to Buy.. for example, if a plot costs $50,000 that amount will be the base for your loan calculation.. having a clear purchase price helps you plan your budget effectively..

Step 2 – Check the Interest Rate Offered by the Lender

interest rates vary depending on the bank, credit union, or government loan scheme.. small difference in rates (e.g.., 6% vs. 8%) can significantly change your Monthly installment.. always confirm the annual percentage rate (APR) before starting the calculation..

Step 3 – Decide Your Down Payment Percentage

most lenders in the US require a down payment for Land loans, typically ranging between 20% – 30%.. For a $50.000 land purchase, a 20% down Payment would be $10.000, reducing the Loan amount to $40.000.. Including this step in how to calculate a land loan ensures moree accurate results..

Step 4 – Choose the Loan Term (Years)

loan term, or repayment period plays a major Role in monthly payments.. A longer term reduces installments but increases total Interest paid.. For example:

- 5-year loan → Higher monthly payments, less total interest..

- 15-year loan → Lower monthly payments, more total interest..

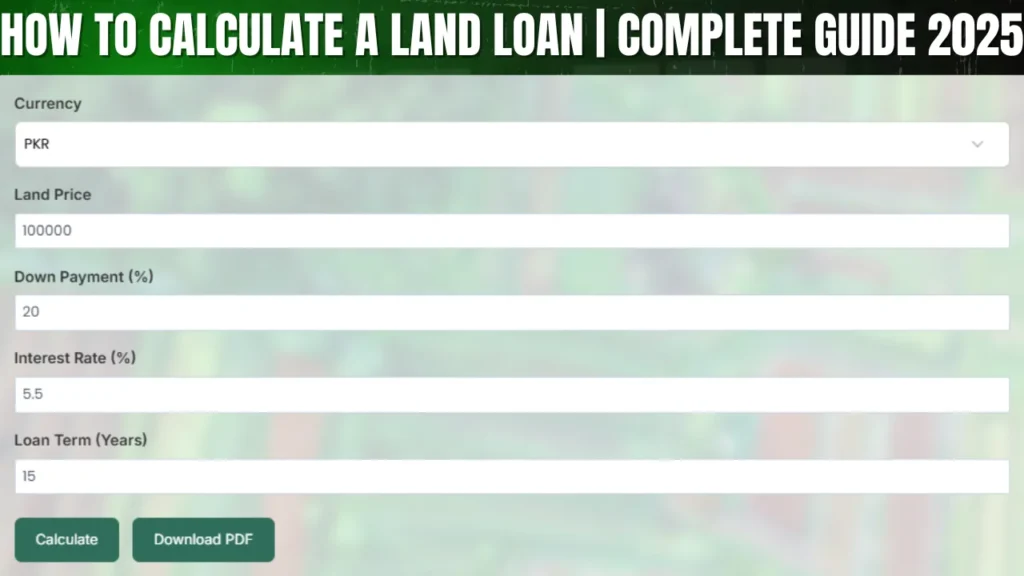

Step 5 – Use a Land Loan Calculator for Accurate Results

Instead of Doing manual math, you can simply enter the Loan amount, interest rate, down payment, and loan term into a land loan calculator.. /within seconds, it shows the estimated monthly installment.. This makes how to calculate a land loan much easier and faster..

👉 Example Table – Monthly Payment Comparison

| Loan Amount | Interest Rate | Loan Term | Estimated Monthly Payment |

| $40,000 | 6% | 5 Years | $773 |

| $40,000 | 6% | 10 Years | $444 |

| $40,000 | 6% | 15 Years | $338 |

✅ This step-by-step guide gives readers a clear roadmap to calculate their loan easily..

Formula for How to Calculate a Land Loan Manually

While Online Calculators make things easier, it’s also useful to know the mathematical formula behind Land Loan calculations.. Understanding this gives you better control and helps you verify if your lender’s numbers are accurate..

The Standard Loan Payment Formula

The formula to calculate monthly loan payments (EMI) is:

EMI=P×r×(1+r)n(1+r)n−1EMI = \frac{P \times r \times (1+r)^n}{(1+r)^n – 1}EMI=(1+r)n−1P×r×(1+r)n

Where:

- P = Loan Amount (Principal)

- r = Monthly Interest Rate (Annual Interest ÷ 12 ÷ 100)

- n = Total Number of Monthly Payments (Loan Term × 12)

Step-by-Step Example

Suppose you want to borrow $40.000 at an Annual interest rate of 6% for a term of 10 years:

- Loan Amount (P) = $40.000

- Annual Interest Rate = 6% → Monthly = 0.06 ÷ 12 = 0.005

- Loan Term (n) = 10 years × 12 = 120 months

- Plug values into the formula:

EMI=40000×0..005×(1+0..005)120(1+0..005)120−1EMI = \frac{40000 \times 0..005 \times (1+0..005)^{120}}{(1+0..005)^{120} – 1}EMI=(1+0..005)120−140000×0..005×(1+0..005)120

👉 Final Monthly Payment ≈ $444

Readmore: Chief Minister Punjab Maryam Nawaz Sharif ne ek zabardast qadam uthaya hai jiska naam hai Apni Zameen Apna Ghar Program.. Is scheme ka maqsad hai Punjab ke gareeb aur beghar logon ko muft 3 marla zameen dena taake wo apna ghar bana saken.. Yeh program “Housing for All” vision ka hissa hai..

Why This Formula Matters

- It shows the exact breakdown of how your payments are calculated..

- It helps you double-check lender calculations for accuracy..

- It allows you to Experiment With Different Interest rates and terms without relying on external tools..

Knowing how to calculate a land loan manually ensures you’re not fully dependent on online calculators and gives you confidence when negotiating with banks..

Affecting Factors How to Calculate a Land Loan

When we try to learning how to calculate a land loan, its important to know that the final payment amount depends on several key factors.. These Variables Influence Your Interest Rate, monthly installment, and total repayment..

1. Type of Land

The type of land you buy plays a huge role in your loan terms..

- Residential land → Easier Approvals, Lower interest rates..

- Commercial land → Higher rates, stricter eligibility checks..

- Agricultural land → Often limited financing options in urban areas..

Lenders usually treat undeveloped plots as less secure collateral., Which Means Calculations For Raw Land often involve higher interest rates..

2.. Loan Amount (Principal Value)

Higher loan amount Increases Both Your Monthly Installments And the total interest you’ll pay.. For example, borrowing $80.000 instead of $40.000 doubles your financial responsibility..

3.. Down Payment Percentage

The larger your upfront payment, the smaller the loan you’ll need to take. For example:

- 20% down payment on $50,000 = $10,000 → Loan = $40,000

- 30% down payment on $50,000 = $15,000 → Loan = $35,000

By increasing your down payment, you lower the loan balance, which directly reduces monthly installments and makes repayment more manageable.

4.. Loan Term (Repayment Period)

When the term is shorter, monthly expenses go up, but long-term interest decreases.. Longer terms reduce monthly payments but increase total cost.. Choosing the right balance is essential when you calculate a land loan..

5.. Credit Score & Financial Profile

In the US, your credit score impacts interest rates.. 700+ scores get better terms, low scores risk rejection..

6.. Location of the Land

Land located in cities like New York, Los Angeles, Chicago, or Dallas may attract different loan terms compared to rural areas.. Developing locations raise land value, which impacts loan interest.

✅ These factors are critical in understanding how to calculate a land loan correctly.. By adjusting these variables in a loan calculator, You’ll Get More Accurate Results Tailored To Your Situation..

📝 Benefits of Using a Land Loan Calculator

When you’re trying to understand how to calculate a land loan, manually working with formulas can be time-consuming.. land loan calculator makes the process simple and gives quick, accurate results..

1.. Saves Time and Effort

Instead of Solving Long Formulas, You Can Simply Enter Loan Amount, interest rate, and term into the calculator.. Know your installment in seconds..

2.. Accurate and Error-Free

Manual Calculations Can Lead To Mistakes, Especially If Numbers Are Large.. The calculator gives accurate results, vital for smart financial choices..

3.. Easy Comparison Between Lenders

You can quickly Compare Multiple Loan Offers By Entering Different Interest Rates and loan terms.. This makes it easier to find the best and most affordable land loan option..

4.. Helps with Budget Planning

By knowing the Exact Monthly Installment, You Can Plan Your Personal or business budget effectively.. Stay within budget and repay smoothly..

5.. Transparency in Loan Process

Using a calculator allows you To See The Breakdown Of Payments, interest amounts, and total cost.. Being clear with numbers boosts your position at the bank..

✅ In short, a land loan Calculator Is An Essential Tool For Anyone who wants to quickly and reliably figure out how to calculate a land loan without confusion..

Step-by-Step Example: How to Calculate a Land Loan Using a Calculator

To understand the process better, lets walk through a practical example using a land loan calculator.. You’ll clearly see how monthly installments are set..

Example Scenario

- Loan Amount (Purchase Price): $60,000

- Down Payment: 20% ($12,000)

- Loan Principal: $48,000

- Annual Interest Rate: 5%

- Loan Term: 15 years (180 months)

Step 1: Enter Loan Amount

Start with the principal amount after Subtracting The Down Payment.. In this case, $48,000..

Step 2: Input Interest Rate

Enter the annual interest rate, which is 5%..

Step 3: Add Loan Term

Choose the repayment period, here it’s 15 years (180 months)..

Step 4: Calculate Monthly Payment

The calculator automatically applies the EMI formula and shows your result..

Table: Calculation Breakdown

| Details | Value |

| Purchase Price | $60,000 |

| Down Payment (20%) | $12,000 |

| Loan Amount (P) | $48,000 |

| Annual Interest Rate | 5% |

| Loan Term | 15 years |

| Monthly Payment (EMI) | $379 |

So in this case, your monthly installment = $379..

Over 15 years, you’ll pay a total of $68,220, which includes both principal and interest..

✅ This step-by-step guide shows how easy it is to figure out how to calculate a land loan using a simple calculator..

📝 Comparing How to Calculate a Land Loan Manually vs Using a Calculator

When it comes to figuring out how to calculate a land loan, there are two main methods: manual calculation and using an online calculator.. Your choice depends on which pros and cons suit you best..

Manual Calculation Method

Pros:

- Builds understanding of the calculation process.

- Useful if you don’t have internet access.

- Helps build financial knowledge.

Cons:

- Time-consuming process.

- Easy to make errors in complex formulas.

- Difficult when checking multiple loans at once.

Using a Land Loan Calculator

Pros:

- Fast, simple, and accurate

- Eliminates human error

- Can compare several lenders in seconds

- Shows full breakdown of EMI, interest, and total cost

Cons:

- Requires internet or software access

- Doesn’t improve your manual calculation skills

Quick Comparison Table

| Feature | Manual Calculation | Land Loan Calculator |

| Time Required | High | Very Low |

| Accuracy | Medium (errors possible) | High (error-free) |

| Ease of Use | Difficult | Easy |

| Comparison Between Loans | Hard | Very Easy |

✅ While both methods work for learning how to calculate a land loan, using a calculator is quicker, simpler, and far more dependable in real situations.

📝 Common Mistakes People Make When Calculating Land Loans

Even with access to tools, many borrowers make errors when figuring out how to calculate a land loan.. Wrong calculations lead to higher payments and stress..

❌ 1.. Ignoring the Down Payment

Some people calculate based on the total purchase price instead of subtracting the down payment.. Makes the loan amount larger than expected..

❌ 2.. Forgetting Additional Costs

Expenses like taxes, insurance, legal fees, and maintenance are often overlooked, which makes the monthly payment seem lower than it actually is.

❌ 3.. Not Checking Interest Type

Confusing fixed-rate and variable-rate loans can drastically change future payments.. Verify loan type before you start..

❌ 4.. Using Wrong Loan Tenure

Choosing a very short tenure may show high monthly payments that aren’t affordable.. Longer tenures mean paying more interest overall…

❌ 5.. Relying Only on One Calculator

Every lender has slightly different terms.. Depending on just one calculator can mislead you.. Compare lenders before finalizing a loan..

❌ 6.. Overlooking Prepayment and Penalty Fees

Many borrowers overlook prepayment charges or penalty fees, which can increase the overall cost of the loan…

👉 By steering clear of these mistakes, you’ll get more accurate land loan calculations that truly reflect the actual costs.

Frequently Asked Questions (FAQs) About How to Calculate a Land Loan

What is the easiest way to calculate a land loan?

The easiest way is to use an online land loan calculator where you enter purchase price, down payment, interest rate, and loan term

What details do I need to calculate a land loan?

You need loan amount, interest rate, loan term, down payment, and sometimes extra charges like taxes or insurance

Do banks in the US provide their own calculators?

Yes, banks like Wells Fargo, Chase, and Bank of America offer free land loan calculators

Is calculating a land loan different from a home loan?

Yes, land loans usually have higher interest rates and stricter eligibility than home loans

Can I calculate a land loan with zero down payment?

Most banks require a down payment.. If zero down payment is allowed, your loan calculation will be based on 100% of the purchase price

Does loan tenure affect the calculation?

Yes, longer tenure reduces monthly payments but increases total interest paid, while shorter tenure does the opposite

Can I use a mortgage calculator for land loans?

Not always.. Land loan calculators are more specific, but some mortgage calculators can still give a close estimate

How do I calculate interest-only land loans?

In interest-only loans, you only pay interest during the initial term.. Calculation = Loan Amount × Interest Rate ÷ 12

What mistakes should I avoid while calculating a land loan?

Ignoring down payment, forgetting extra costs, or using the wrong loan tenure are the biggest mistakes

Are online calculators accurate?

Yes, but results may vary slightly since each bank uses different policies and fees

Can I calculate a land loan for agricultural land?

Yes, the method is the same, but interest rates and eligibility criteria may differ from residential land

Do I need to include property tax in the calculation?

Yes, if your lender adds property tax into monthly installments, you should include it

Can I calculate subsidy or government schemes in my land loan?

Yes, you can subtract the subsidy amount before calculating EMIs

How does credit score affect land loan calculation?

A higher credit score means lower interest rates, which reduces your total EMI calculation

Is it possible to calculate bi-weekly land loan payments?

Yes, instead of 12 monthly payments, you divide the loan into 26 half-payments in a year

Do U..S.. government loans have different calculations?

Government-backed loans like USDA or FHA loans may have lower rates, but the formula for calculation is the same

Can I calculate future savings if I prepay?

Yes, by reducing the principal early, your future EMIs and total interest can be recalculated lower

Should I calculate loan insurance with my EMI?

Yes, if your lender makes it compulsory.. Otherwise, you can calculate it separately

Readmore: For Land Loan Calculation Visit Homepage Calculator